The DealMakers AFRICA Q3 2025 is out now!

DealMakers AFRICA Annual Awards - March 2026

Lagos, Nigeria & Nairobi, Kenya

DealMakers AFRICA Q1 2024 issue

DealMakers AFRICA 2023 Awards | Lagos, Nigeria | March 2024

THORTS

Unlocking Africa’s potential: The rise of AI investment on the continent

by Tayyibah Suliman and Lutfiyya Ramiah | Cliffe Dekker Hofmeyr

Recent developments in Competition Law

by Nazeera Mia | Bowmans

Ten important considerations when filing multi-jurisdictional mergers in Africa

by Martin Versfeld, Lebohang Makhubedu, Patrick Smith, Ricky Mann and Daniela Lamparelli | Webber Wentzel and RBB Economics

Capitalising on opportunity: African M&A to rise in 2024 and beyond

by Jens Kengelbach | Boston Consulting Group

Capital Gains Tax and its impact on offshore indirect transfers in Kenya

by Alex Kanyi, Lena Onyango and Judith Jepkorir | CDH Kenya

CONTENTS

FROM THE EDITOR'S DESK

This year, no fewer than 20 African countries are scheduled to have national elections, with citizens engaging in electoral processes that will shape the trajectory of their governance and economic progress. According to the African Centre for the Constructive Resolution of

Disputes (ACCORD), the large scale of elections poses both challenges and opportunities for the continent’s political stability. Of the 20 elections, 30% will be in Southern Africa, 25% in West Africa, 20% in North Africa and 10% in Central Africa. Roughly half of these elections are unlikely to be competitive, with well-entrenched incumbents protected by long legacies of direct or indirect military government.

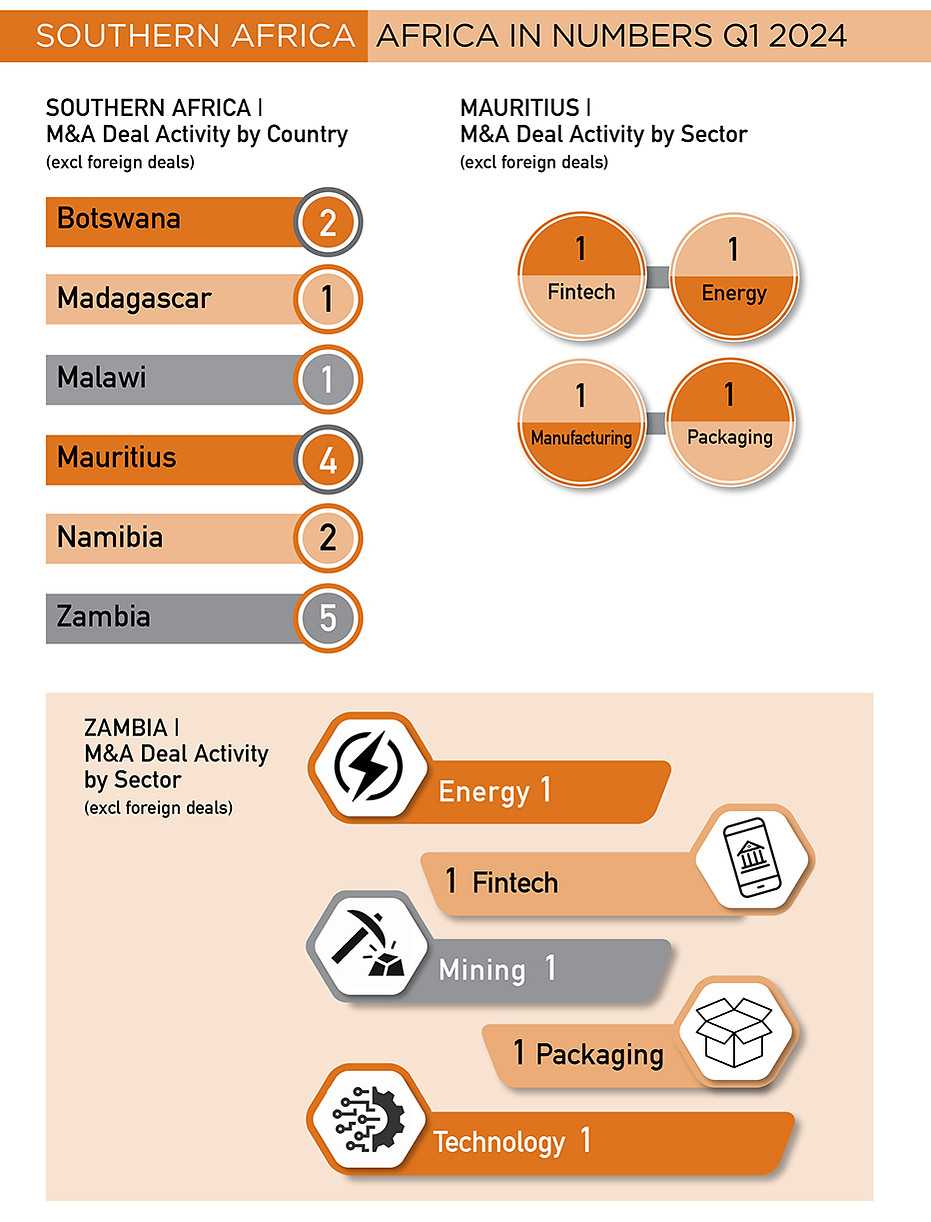

Analysis by DealMakers AFRICA of the M&A data for Q1 2024 (excluding South Africa and failed deals) shows 102 local deals were announced across the continent, valued at US$3 billion – down from the 133 deals valued at $3,7 billion from the same period last year.

Private Equity activity continues to be strong across the continent – in Q1, it represented 62 of the 102 deals announced, valued at $303 million (page 4). The three most active regions – East, West and North Africa – account for 84% of the deals announced, and 51% of all M&A activity for the period. In terms of total deals, West Africa continued to dominate (recording $2,6 billion in value) with Nigeria the centre of activity (20 deals). It was followed by East Africa, which recorded deal values in aggregate of $44 million. Kenya was the most active of the East African countries, recording 19 deals of the 28 for the region (page 3).

The top 10 deals announced in Q1 2024 (by value) are listed on page 6. Of these, the largest was the disposal by Shell of its onshore oil and gas subsidiary to Renaissance Africa Energy for $2,4 billion. While Africa faces many challenges – both internal and external – opportunities abound, with the world’s largest mineral reserves and huge potential to produce

energy from renewable sources. To this point, the articles in this issue make for interesting reading.

The DealMakers AFRICA 2023 Annual Awards, held for the first time in Lagos in March this year, was a great success, one of celebration and networking with the region’s dealmakers. Pictures of the event and the winning teams are included in this issue.

THORTS

Unlocking Africa’s potential: The rise of AI investment on the continent

Tayyibah Suliman and Lutfiyya Ramiah

Investing in Artificial Intelligence (AI) technologies is no longer a luxury. It is a necessity to make sure countries are prepared for the changes and challenges that lie ahead.

In the dynamic landscape of technological innovation, AI stands out as a transformative force with seemingly endless potential.

Lloyd’s Register Foundation conducted a study in 2021, to assess whether people across the world believed that AI would hurt or help. African participants in the survey expressed significant scepticism, with some regions in Africa indicating concerns that AI would prove to be dangerous. This scepticism is perhaps not unfounded when considering that similar reservations have been expressed by the likes of Stephen Hawking about the possibility that AI will outwit and oust humans altogether over time.

Notwithstanding any scepticism, experts concur that AI will be transformative, and is here to stay. In Africa, the use of AI tools is currently more likely to be embedded in broader technology solutions to address civic and socio-economic imperatives. In line with this, several key investments were made in AI across Africa, in 2023 and 2024, with a focus on sectors such as healthcare, agriculture, finance and education.

While these investments are a positive indicator, it is important to note that Africa is still contending with a digital literacy divide. Statista reports published in 2024 indicate that the highest level of internet penetration in Africa is in Morocco, at 91%, and the lowest level of internet penetration is a startling 10.6% in the Central African Republic.

Tayyibah Suliman

Lutfiyya Ramiah

This digital divide is likely to continue to affect the prospects of AI investment in Africa, with more investments being focused on territories where there is access to internet connectivity, and where there are higher levels of digital literacy across the citizenry. The unfortunate result of this is that the countries that are most in need of AI tools that can improve their lives are unlikely to be the recipients of these technology developments without investment in reducing the digital divide at the outset.

In its Heartbeat report on the TOP AI companies in Africa in 2023/2024, Sovtech found that the global AI market was valued at “$428 billion and is projected to escalate dramatically from $515,31 billion in 2023 to an astounding $2025,12 billion by 2030”. In terms of Africa, it reports a startling contrast for the AI market in Africa, which was only projected to reach “$5,20 billion in 2023, with an expected annual growth rate of 19.72% leading up to 2030, culminating in a market volume of $18,33 billion”.

These statistics provide a positive outlook that the use of and investment in AI is likely to grow substantially in Africa and the rest of the world, albeit disproportionately.

Chat GPT and Gemini have dominated the headlines as AI tools suited to mainstream use; however, the use of AI has far more novel and extensive uses in various other industries across Africa.

Cliffe Dekker Hofmeyr’s Pro Bono and Human Rights practice has been involved in supporting and advising Kwanele, a non-profit organisation that has integrated an AI chatbot into an app that will support victims of gender-based violence to get the necessary guidance and assistance from any location in South Africa.

Some other notable developments are highlighted below, with reference to various industries in Africa that have already been the beneficiaries of AI investments.

AGRICULTURE

In 2023, KaraAgro reported on an AI project empowering Ghanaian cashew farmers by employing unmanned aerial vehicles equipped with AI-driven disease detection capabilities. These aerial robots meticulously collect data from the leaves, stems, and trunks of cashew trees. By identifying pest and disease symptoms before they become visible, farmers can take timely action to prevent serious crop damage. Another AI initiative predicts post-harvest shortages and excesses; this technology aims to improve the prediction models for crop yield, supporting greater food security for Ghana and the broader region. Given the unpredictability inherent in managing smallholding farms, the project will assist farmers to gain a more sustainable income. These innovative AI solutions hold promise and are key developments in the areas of agricultural productivity and food security, directed to enhance crop monitoring, pest control and yield optimisation, addressing food security challenges across the continent.

FINTECH

The use of AI has flourished in the fintech industry, where investments in AI-based fintech solutions have expanded to provide access to financial services, improve credit scoring, and combat fraud in the banking and financial sectors. Sygnia Itrix FANG reports that it has taken the initiative to allow South African investors to align with the Johannesburg Stock Exchange’s first AI-focused, actively-managed, exchange-traded fund, and secure access to high-growth technology and AI stocks at the touch of a button.

EDUCATION

In the education sector, AI-driven educational tools and platforms have been implemented to enhance learning outcomes, personalise learning experiences, and develop skills for the future workforce. Mtabe, an education-tech start-up uses AI to provide personalised learning to students in Tanzania by analysing every student’s learning style and progress, and then generating learner-specific content tailored to each student’s individual requirements.

INFRASTRUCTURE

Omdena – a Palo Alto-based, grassroots AI organisation – participated in a challenge to leverage AI to predict the infrastructure needs of African countries (by considering various data sources, such as satellite images; socio-economic data; climate and topological data; population and demographic data; Google Trends; Google business data; and social media data) and to understand the aspirations, needs and sentiments of people living in the region. This project is indicative that AI will be a formidable tool in assessing and planning for infrastructure development across the continent.

CONCLUSION

These are good examples of how – by fostering an enabling environment that encourages innovation, entrepreneurship and skills development – Africa can fully harness the transformative power of AI to drive socio-economic development, and to address the multiple and monumental challenges that have not been addressed, through the use of technology augmented by AI.

The prospect of any investment in AI in Africa is promising, but it is clear that more can be done to support the reduction of the digital divide, and to ensure that there are proactive policies and a commitment to inclusivity for Africa to chart a course towards a future where AI serves as a catalyst for prosperity, empowerment and sustainable development across the continent.

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

Suliman is Sector Head of Technology & Communications and Ramiah a Candidate Attorney at

Corporate & Commercial | Cliffe Dekker Hofmeyr

Recent developments in Competition Law

THORTS

Nazeera Mia

There has been a dynamic transformation in Africa’s competition law landscape, characterised by a concerted effort to adopt and modernise competition regulation, enhance enforcement mechanisms, and foster greater cooperation for regional integration.

ADOPTING AND MODERNISING COMPETITION LAW

Competition law enforcement across Africa continues to evolve as new regulation is introduced and existing rules are tightened. Notable recent highlights include:

• The AfCFTA Competition Protocol was adopted in February 2023. The Protocol provides for the establishment

Nazeera Mia

of a continental competition regulator, and adopts a hard law approach to competition law enforcement.

• Dedicated competition legislation was introduced in Lesotho during 2022, and in Uganda early in 2024.

• Amendments to existing competition legislation in the Economic and Monetary Community of Central Africa, Egypt, Morocco and Zambia were adopted, and material amendments are proposed for the competition law regimes in the Common Market for Eastern and Southern Africa (COMESA); the East African Community (EAC) and Tanzania. It is also proposed that the Competition Act in various countries, including in eSwatini, Malawi, Namibia and Zimbabwe, be repealed. A draft Competition Bill for each of these countries is at various stages of assent.

• Plans are afoot to operationalise the Burundi Competition and Consumer Protection Commission, the National Competition Commission of Comoros, and the Competition Commission of the Democratic Republic of Congo. It is also envisaged that the EAC Competition Commission will soon adopt an ex-ante merger control regime and become fully operational in respect of all areas of competition law enforcement.

ENFORCEMENT

• The Egyptian Competition Authority (ECA) recently issued a statement detailing its enforcement activities, which spanned horizontal and vertical restraints, merger control, and abuse of dominance. The ECA explained that it filed a criminal case against four egg brokers for alleged collusion; proved tender collusion against a number of companies supplying electric poles and iron pipes used in the manufacture of equipment to generate electricity; proved collusive price increases in relation to textbook distribution; and proved tender collusion against two suppliers of auto parts to the Public Transport Authority in Cairo. The ECA also proved abuse of dominance by two schools that entered into exclusive agreements relating to the purchase of school uniforms.

• Front of mind in South Africa has been the approach by the Competition Commission of South Africa (CCSA) to the assessment of the public interest factors under the merger control provisions in the Competition Act, 89 of 1998 as amended (Act). Early in 2024, the CCSA published Revised Public Interest Guidelines in Merger Control, which adopt the perspective that there is a positive obligation on all merging parties to promote a greater spread of ownership by historically disadvantaged persons and workers. Various stakeholders have submitted comments, and we are likely to see revised guidelines later this year. From a behavioural perspective, the CCSA implemented its wider investigation powers under the Competition Amendment Act, 2018, particularly in the field of market inquiries. Notably, some 45% of all market inquiries conducted by the CCSA since 2006 were launched and/or concluded during 2023 and 2024.

• 2023 marked a decade of competition law enforcement in the COMESA region, with the COMESA Competition Commission reporting that, over this period, it had reviewed and taken decisions on some 360 merger transactions; investigated more than 40 cases of restrictive trade practices; conducted more than 12 market studies and market screening exercises; fined three businesses for non-compliance with the merger control aspects of the COMESA Competition Regulations; concluded 14 Memorandums of Understanding (MOUs) with member states; and provided capacity building and technical assistance to competition regulators and government institutions in 19 of its 21 member states.

Moreover, the Commission recently fined football marketing firms US$300,000 each for allegedly engaging in an anti-competitive business practice, and commenced investigations against American Tower Corporation and Airtel Africa for alleged anti-competitive behaviour. The Commission’s investigations into the pricing of COVID-19 PCR testing kits by various pathology firms and alleged territorial restrictions and retail price maintenance by Toyota Tsusho Corporation remain ongoing.

• In Kenya, the Competition Authority of Kenya (CAK) fined a leading retailer in Kenya KES1 billion (~US$7,6 million) for alleged abuse of buyer power, and also fined nine steel manufacturers KES338 million (~US$2.5 million) for alleged price fixing and output restrictions – these are the highest penalties yet to be imposed by the CAK.

• In Mauritius, enforcement remains a key priority of the Competition Commission (CCM), and several investigations were launched during the year. The CCM fined six producers of deer/venison for alleged collusive conduct, and conducted several market studies.

• In Namibia, the Namibian Competition Commission (NaCC) concluded settlement agreements with five pharmaceutical companies after investigating price fixing among the firms under the auspices of an industry association. The NaCC is also investigating firms in the poultry industry for alleged abuse of dominance.

• In Zambia, the Competition and Consumer Protection Commission fined roofing companies 8.5% of their annual turnover for allegedly sharing pricing information and coordinating on simultaneous price increases for the provision of roof sheeting via WeChat.

• The Zimbabwe Competition and Tariff Commission issued record-breaking fines for the prior implementation of notifiable mergers.

ENHANCED COOPERATION AND REGIONAL INTEGRATION

The COMESA Competition Commission has previously embarked on several initiatives to enhance cooperation and coordination among competition regulators in member states. The Commission hosted workshops and capacity building training with, among others, the Burundi Competition Commission; the National Competition Commission of Comoros; the Competition Commission of the Democratic Republic of Congo; the Ethiopian Ministry of Trade; and the Malawi Competition and Fair Trading Commission.

The Commission also revised existing MOUs with, among others, the Competition Authority of Kenya and the Zambia Competition Commission, indicating that revisions were necessary to deepen collaboration and facilitate a greater exchange of information.

It also signed an MOU with the Eurasian Economic Commission. The two institutions intend to cooperate in the exchange of non-confidential information, experiences and best practices in competition case investigations and research.

Mia is a Knowledge and Learning Lawyer: Competition | Bowmans

THORTS

Ten important considerations when filing multi-jurisdictional mergers in Africa

Martin Versfeld, Lebohang Makhubedu, Patrick Smith, Ricky Mann and Daniela Lamparelli

Webber Wentzel and RBB Economics recently advised on two transactions that featured unprecedented levels of antitrust scrutiny across multiple African countries. The first transaction involved Dutch brewer, Heineken‘s acquisition of a controlling interest in Namibia Breweries, and the flavoured alcoholic beverages, wine and spirits operations of Distell. The second transaction involved Dutch coatings manufacturer, Akzo Nobel (which manufactures the well-known Dulux paint brand) acquiring Japanese coating manufacturer, Kansai Paint’s two African entities, one of which owns the Plascon brand.

Navigating complex regulatory requirements, each merger underwent competition assessment before various competition authorities in over 20 jurisdictions, a process that spanned at least 18 months from the risk assessment phase to litigation. The in-depth scrutiny and rigorous assessments by African competition authorities signal a positive welcome to the modernisation of African antitrust regimes. This mirrors the evolution of European competition law three decades ago, and we anticipate this positive trend to solidify further.

These transactions serve as useful case studies that offer insights into critical procedural and strategic considerations, which are important for businesses to keep in mind for future transactions that require merger filings across Africa.

CONSIDERATIONS FOR NAVIGATING COMPLEX MERGERS ACROSS AFRICA EARLY RISK ASSESSMENT

The first step is for a business’ economics and legal team to conduct a preliminary risk assessment as soon as practicable, to identify potential substantive regulatory concerns, as well as to inform and develop a merger clearance strategy. This analysis should include identifying jurisdictions that may raise competition risks, public interest issues (such as job losses), and any potential structural and behavioural remedies.

THE ORDER OF MERGER FILINGS

To make informed filing decisions, parties must weigh the economic and commercial importance of the deal in each jurisdiction, the competition authority’s appetite to engage in substantive economic analysis, the complexity and resolution of competition issues, and the likelihood of public interest issues arising. While South Africa remains the likely focal point for the foreseeable future, the Common Market for Eastern and Southern Africa (COMESA) regional competition authority is playing an increasingly crucial role, due to its authority to assess the effects of a merger across 21 countries. Following Webber Wentzel and RBB Economics‘ extensive engagements with COMESA, it was observed that although the COMESA centralised filing process has cost-saving benefits, parties should expect increased complexity in the investigation process that follows. COMESA is adopting an increasingly rigorous approach when assessing the merger parties’ economic arguments and analysis. Allowance also needs to be made for the fact that COMESA has to engage with and secure input from all local authorities within the member states affected by the transaction, making for a lengthy and complex process. Some affected member states are inclined to request that the merger be referred to them. Typically, COMESA denies these requests and seeks to accommodate the concerns on the part of local competition authorities by allowing them to send information requests (while keeping COMESA in copy), and to hold meetings with the merger parties subject to a reporting obligation.

MANAGING THE TIMING OF MULTI-JURISDICTIONAL MERGERS

Ensuring a smooth timeline for a multi-jurisdictional merger across Africa requires meticulous time management. Firstly, factor in the extended review periods required by each jurisdiction where merger filings are required. Secondly, advisors must dedicate time and effort to collecting and analysing significant volumes of information and data, as well as engaging extensively with multiple stakeholders within the merger parties’ businesses (including the head office and local operations teams) to provide comprehensive and accurate responses to the various information requests from the competition authorities. It is also essential to build timing buffers into one long stop date to allow for unexpected delays, particularly in African countries where comprehensive information and data may not be readily available from the merger parties’ local operations.

Martin Versfeld

.jpg)

Lebohang Makhubedu

Patrick Smith

Ricky Mann

Daniela Lamparelli

ADDRESS ANY POTENTIALLY NEGATIVE OPTICS/PRECONCEPTIONS UPFRONT

Competition authorities are highly sceptical of transactions that involve well-known brands that appear to create or strengthen structural presumptions of market power. Early engagements with authorities can assist to:

(i) shift the debate towards substantive rather than ostensible issues;

(ii) establish the authority‘s appetite for more objective economic analysis; and

(iii) ascertain the need for a remedy if these presumptions seem insurmountable.

BUILD A STRONG MERGER RATIONALE

At the outset, merger parties should develop and test a coherent and consistent strategic justification for the proposed transaction. It is advisable to involve the advisory team in conceptualising and testing the transaction rationale. In Webber Wentzel and RBB Economics‘ experience, a poorly articulated strategic justification (or no genuine justification at all) can unhelpfully detract from the substance of a case.

HAVE THE RIGHT TEAM TO CO-ORDINATE THE VARIOUS OVERLAPPING PROCESSES

Mergers spanning multiple African countries create a complex web of overlapping filing deadlines. This requires an advisory team with the depth of experience and size to prepare simultaneous submissions. The team must be prepared to meet specified deadlines and attend in-person meetings, site visits and public hearings across several jurisdictions.

ENSURE CONSISTENCY IN MERGER FILINGS

Competition authorities in Africa don’t operate in silos; they share information and reference each others justifications and decisions for guidance when evaluating mergers. This collaboration has several implications, but most importantly, it means that submissions across jurisdictions must be consistent in their content and underlying data. This ensures a clear and unified picture for the competition authorities involved. Among these regulators, COMESA and the South African, Namibian and Botswanan Commissions, in particular, are known for their active information exchange (while adhering to confidentiality restrictions).

INCREASING LEVELS OF SCRUTINY FROM COMPETITION AUTHORITIES

African mergers are being confronted by an ever-increasing level of scrutiny, necessitating a well-developed response strategy. Beyond the initial submissions, competition authorities are also increasingly inclined to conduct in-depth assessments and investigate complex theories of harm. This includes non-horizontal theories of harm initiated by third parties, such as customers and intervenors. Furthermore, authorities are no longer prepared to rely only on information provided by merging firms and will look to corroborate or refute these with evidence from third parties (or desktop research).

PUBLIC INTEREST IS BECOMING MORE RELEVANT

African competition authorities are following in the footsteps of South African precedent. They are seeking to negotiate public interest commitments (such as moratoriums on job losses and requiring local procurement and supply commitments). Unfortunately, this is the case even when they are dealing with mergers with very limited competition concerns. It is helpful to consider, well in advance, how you plan to address anticipated requests for public interest commitments. It should also be borne in mind that conceding to proposals in one country might invite requests for similar remedies in other countries, which can become costly and difficult to implement.

REMEDY DESIGN SHOULD ALIGN WITH THE ECONOMIC EVIDENCE

When designing a remedy, it is vital to consider its substance, implementation, commercial feasibility, and flexibility across jurisdictions. Remedies in multi-jurisdictional transactions may have a geographical component because of the businesses’ cross-border operations and the market definition adopted in the filing (e.g. regional markets may require regional remedies). Furthermore, African competition authorities are becoming increasingly aware of how a remedy in one country affects another, and they might adjust your proposed remedies accordingly.

While Africa continues to offer attractive commercial opportunities, if regulatory approvals are required to realise these opportunities, it is important to heed the necessary procedural and strategic considerations. Securing and retaining legal advisors with experience in multi-jurisdictional African filings from the very beginning is crucial. Their expertise can streamline the efficiency of the approval processes. Furthermore, securing legal advisors at an early stage also ensures that your internal strategic documents align with the narrative required to support approval for the merger filing.

Versfeld is a Partner and Makhubedu, a Senior Associate | Webber Wentzel

Smith is a Partner, Mann, an Associate Principal, and Lamparelli, a Senior Associate | RBB Economics

Capitalising on opportunity: African M&A to rise in 2024 and beyond

THORTS

Jens Kengelbach

After a post COVID-19 lull, mergers and acquisitions (M&A) activity on the African continent is set for an exciting new phase, as investors see opportunities to deploy capital.

According to our research over the last 10 years, deal activity in Africa has averaged around US$28 billion in value, and there have been approximately 600 deals per year. Apart from bumper years, activity in most years fluctuated around these averages. In 2021, for example, the continent saw significant transactions by BP and Eni, which pushed the deal value up. Another exception was in 2023, when we saw only $7 billion in deal value across 440 deals – a 71% drop in deal value compared to 2022.

When looking at the geographic locations of these transactions, we observe that most deals target South African companies. But other economies like Morocco, Egypt, Nigeria and Kenya are catching up, and becoming increasingly attractive for acquirers.

Jens Kengelbach

We believe that there are several catalysts that may align to reverse the trend of below-average activity in recent years, and push M&A activity on the African continent to new heights.

Firstly, a look at global trends in M&A suggests that companies have strengthened their balance sheets, have excess cash on hand to invest, and are forecasting a more stable interest rate environment. While this should be seen in the context of increased geo-political uncertainty, companies may also utilise this period to look at cross-industry transactions to help them meet their digitisation and sustainability-linked goals.

The second trend is that there remains robust demand for African assets, with roughly half of the 2023 deal value being inbound activity – these are classified as non-African acquirers buying African assets. In 2023, we saw the second-highest share in the last 10 years with 57% of deal value from such deals. One connected trend is the increasing presence of Chinese buyers on the continent. Their share in deal value increased from 2% in 2014 to 7% in 2023, with a tendency to be involved in larger deals.

Sector-wise, we saw most of the transactions take place in the materials and energy and power industries, with 27% and 25% respectively in 2023. This is a shift compared to 2014, where these two sectors combined accounted for only about a quarter of aggregate African deal value.

This trend is expected to continue into 2024. Transactions in the energy and power clusters will be fuelled by major international oil companies optimising their portfolios through divestments of non-core assets, particularly in Africa. These companies, acting as the main sellers, are shifting away from non-strategic assets, driving interest not only in fossil fuels, but also in renewable energy sources and infrastructure development.

As African economies aim for energy diversification and independence, the focus on renewable resources and sustainability is increasing, indicating a move towards more self-sufficient and environmentally friendly energy production.

On the materials front, the rise of the green economy and the so-called “metals of the future” cluster – cobalt, manganese, copper and lithium – are expected to attract investor attention, especially in Africa.

A third trend which is expected to contribute to higher M&A activity in Africa is the increasing activity of financial buyers – classic private equity investors, or a slightly newer class of financial sponsors in the form of Sovereign Wealth Funds (SWFs). With African markets maturing, these buyers have almost doubled their share of total deal-making from 8% in 2014 to 14% in 2023. One of the drivers of these transactions is the increased participation of Middle Eastern SWFs, looking to diversify their investments outside their home markets. An example is the Eastern Co, a tobacco company based in Egypt, which was acquired by UAE’s Global Investments for approximately US$625 million.

The fourth trend on the African continent is more structural, where increased optimism around deal-making is supported by game-changing initiatives like the African Continental Free Trade Area (AfCFTA), which is expected to enhance intra-African trade and M&A activity.

Should the increased M&A activity materialise through these trends, we believe that there are several opportunities for businesses to benefit. However, it’s not guaranteed that the companies which participate in deal-making create value from it. To do so, companies must follow a clear set of rules, which have proven to drive success in other regions already. Our research has shown that the following factors, among others, are pivotal for success:

• Be prepared and systematic: Have the right team, tools and processes in place to act on M&A opportunities.

• Acknowledge the risk: Doing M&A in lesser-developed economies comes with an additional risk to the already challenging odds of creating value from transactions.

• Build experience: Experience matters in M&A, as our research has shown.

• Master the art of timing: In M&A, as in many other areas of business, timing is half the battle.

• Double down on integration design and execution: The importance of execution for successful deal outcomes cannot be overstated.

Rich in mineral resources, with a youthful population and maturing financial markets, and strategically positioned between key trade routes, the African continent represents an exciting frontier market for investors. We anticipate that these trends will contribute toward a healthy M&A environment. Historically, acquirers in Africa have created slightly more value from their deals, compared with the global average; however, the odds of creating value are, at the same time, lower. Companies that keep an eye on the trends shaping the M&A market in Africa and prepare for successful deal-making are sure to be presented with an historic opportunity.

Kengelbach is Managing Director and Senior Partner; Global Head of M&A | Boston Consulting Group

THORTS

Capital Gains Tax and its impact on offshore indirect transfers in Kenya

Alex Kanyi, Lena Onyango and Judith Jepkorir

It was expected that the steady rise in foreign investments in Africa would result in an equally steady increase in tax revenue. As this has not been the case, African countries have embarked on reviews of their tax policies in an effort to get as much tax revenue in the net as possible. One type of fish, Capital Gains Tax (CGT) seems to have been avoided by both the African governments and the investors, yet it counts for a big percentage of the potential tax revenue collectable from the foreign investments. For instance, in 2020, an analysis by Oxfam highlighted that in just seven disputes emanating from CGT avoidance by multinationals, an amount of US$2,2 billion was in contention.

This article takes a deep dive into the specific steps taken by Kenya to ensure an increase in the amount of CGT collected from both onshore and offshore transactions. In light of this, it is imperative for potential investors to carefully review their activities, to ensure that they are not adversely affected by the changing laws in Kenya and the aggressive position taken by the Kenya Revenue Authority (KRA).

A LOOK AT KENYA

In Kenya, CGT has traditionally been levied on gains made from the transfer of property, whether or not acquired before 1 January 2015. The applicable rate went up from 5% to 15% of the net gain, beginning 1 January 2023.

The Finance Act, 2023 (the Act) ushered in a new regime for CGT in Kenya. Of relevance to this article is the fact that, effective 1 July 2023, gains from the sale of shares in foreign entities that derive more than 20% of their value directly or indirectly from immovable property situated in Kenya shall now be subject to CGT. Immovable property is defined within the Act to include land and things attached to the earth or permanently fastened to anything attached to the earth, an interest in a petroleum agreement, mining information or petroleum information. Please see the following illustration.

Figure 1 is an illustration of an onshore transfer of shares in a company situated in Kenya. A and B are individuals owning 80% and 20% respectively of the shareholding in KenyaCo. B is transferring half of his shares in KenyaCo (10%) to C. Before the Act came into force, only transfers of this nature (happening in Kenya) were subject to CGT.

Figure 1: Before the Act

Alex Kanyi

Lena Onyango

![Judith Jepkorir_background_edited[18].jpg](https://static.wixstatic.com/media/cf215e_53082ab29548497691561cfecb7866f5~mv2.jpg/v1/crop/x_279,y_90,w_654,h_814/fill/w_155,h_193,al_c,q_80,usm_0.66_1.00_0.01,enc_avif,quality_auto/Judith%20Jepkorir_background_edited%5B18%5D.jpg)

Judith Jepkorir

Figure 2 is an example of an offshore indirect transfer now subject to CGT in Kenya. In the illustration, Mauritius Holdco indirectly derives more than 20% of its value from immovable property located in Kenya, owned by its subsidiary, KenyaCo. As such, it is liable to pay CGT in Kenya.

It is noteworthy that pursuant to the Act, non-residents holding more than 20% or more of the shareholding in a resident company, directly or indirectly, are subject to CGT on the disposal of their interest in the company. Please see the following illustration:

Figure 2: After the Act

In Figure 3, X is a non-resident who owns Offshore Limited. Offshore Limited and Y (a Kenyan individual) each own 50% of the shares in KenyaCo, a resident company. X is transferring 30% of the shares in Offshore Ltd to A, a non-resident. According to the Act, transactions of this nature by non-residents are now also subject to CGT in Kenya.

This recent development was not only effected in law, it has also been enforced by the judicial organs. More specifically, the Tax Appeals Tribunal, in the case of Naivas Kenya Limited v Commissioner of Domestic Taxes (2022) and ECP Kenya Limited v Commissioner of Domestic Taxes (2022),

Figure 3: After the Act

determined that the Kenya Revenue Authority (KRA) had not erred in taxing the gains from the sale of shares in Mauritius-based entities, for the reason that they were being managed and controlled from Kenya.

It is notable that the assessment in both cases related to corporation tax and not CGT. This points to the aggressive position taken by the KRA not just to pursue 15% CGT, but corporation tax at 30% for an offshore indirect transfer that derives value in Kenya.

International best practice

Tax treaties are at the centre of international cooperation in tax matters, such as tackling international tax evasion. To prevent double taxation, they would typically award taxing rights to either the resident state or the state where the asset is located.

Kenya has aligned itself to International best practices, including the OECD Model Tax Convention and United Nations (UN) Article 13 (4). Both the UN and OECD Model Tax Convention stipulate that gains derived by a resident of a Contracting State from the alienation of shares or comparable interests, such as interests in a partnership or trust, may be taxed in the other Contracting State if, at any time during the 365 days preceding the alienation, these shares or comparable interests derived more than 50% of their value directly or indirectly from immovable property situated in that State.

Conclusion

For commercial reasons, Foreign Direct Investors may opt to invest through offshore entities. However, the recent developments in Kenya call for a review of this approach. Kenya and other countries have taken steps to implement concrete measures to effectively collect CGT from capital gains realised through such transactions, and the taxation of offshore indirect transfers is already a fully established international tax norm.

Investors with offshore operations should, therefore, consider taking a step back to ensure that their legal, operational and transactional structures adapt to the changing tax regulations. This calls for expert guidance to identify any potential weaknesses in the existing structures, as well as to advise on and implement the necessary adjustments to maintain tax compliance, minimise tax exposure, and guarantee sustainability.

It is important for global investors to carefully review the tax impact for investments that derive their value from Kenya, to ensure that the risk of CGT and Corporation Tax on offshore indirect transfers is addressed.

Kanyi and Onyango are Partners, and Jepkorir a trainee Advocate | CDH Kenya